Why Did Burger King Have the Zero Beef Burger

Eros International Medi...

Insights

View All

-

Meeting Agenda: Audited Results. Please add to watchlist to track closely.

-

Company has posted a profit of Rs 33.76 cr in 31 Dec, 2022 quarter after 3 consecutive quarter of losses. (Source: Consolidated Financials)

-

Stock gave a 3 year return of -61.33% as compared to Nifty Smallcap 100 which gave a return of 30.79%. (as of last trading session)

-

Company has spent 40.41% of its operating revenues towards interest expenses and 19.06% towards employee cost in the year ending 31 Mar, 2021. (Source: Consolidated Financials)

Key Metrics

- -1.85

- -14.86

- 264.16

- 29

- 0.24

- 0.00

- 10.00

- 0.44

- 27.31

- -1.85

- -14.86

- 263.20

- 32

- 0.24

- 0.00

- 10.00

- 0.62

- -

Key Metrics

- -1.85

- -14.86

- 0.00

- 27.31

- 0.24

- 264.16

- 10.00

- 109.88

- 29

- 38.40 / 16.45

- 0.44

- 0.92

- -1.85

- -14.86

- 0.00

- -

- 0.24

- 263.20

- 10.00

- 109.88

- 32

- 38.45 / 16.35

- 0.62

- 0.92

Returns

- 1 Day 4.95%

- 1 Week 6.78%

- 1 Month -11.56%

- 3 Months 16.0%

- 1 Year -15.62%

- 3 Years -61.39%

- 5 Years -87.75%

- 1 Day 4.97%

- 1 Week 6.81%

- 1 Month -12.02%

- 3 Months 15.34%

- 1 Year -15.93%

- 3 Years -61.45%

- 5 Years -87.79%

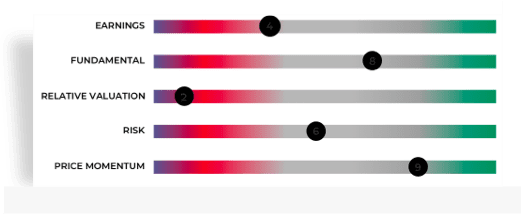

Recommendations

Financials

-

Income (P&L)

-

Balance Sheet

-

Cash Flow

-

Ratios

-

Insights

-

PAT: Entering the Green

Company has posted a profit of Rs 33.76 cr in 31 Dec, 2022 quarter after 3 consecutive quarter of losses. (Source: Consolidated Financials) -

Employee & Interest Expense

Company has spent 40.41% of its operating revenues towards interest expenses and 19.06% towards employee cost in the year ending 31 Mar, 2021. (Source: Consolidated Financials)

Quarterly | Annual Dec 2021 Sep 2021 Jun 2021 Mar 2021 Dec 2020 Total Income 233.06 105.07 40.03 141.74 81.36 Total Income Growth (%) 121.81 162.48 -71.76 74.21 -23.48 Total Expenses 195.12 114.06 59.16 226.10 82.33 Total Expenses Growth (%) 71.07 92.80 -73.83 174.63 0.67 EBIT 37.94 -8.99 -19.13 -84.36 -0.97 EBIT Growth (%) - - - - -103.95 Profit after Tax (PAT) 33.76 -13.02 -42.86 -120.41 -27.53 PAT Growth (%) - - - - - EBIT Margin (%) 16.28 -8.56 -47.79 -59.52 -1.19 Net Profit Margin (%) 14.49 -12.39 -107.07 -84.95 -33.84 Basic EPS (₹) 2.82 -1.36 -4.47 -12.57 -2.90 All figures in Rs Cr, unless mentioned otherwise

-

-

Annual FY 2021 FY 2020 FY 2019 FY 2018 FY 2017 Total Assets 2,413.90 2,496.67 4,205.72 3,786.84 3,675.82 Total Assets Growth (%) -3.32 -40.64 11.06 3.02 5.00 Total Liabilities 1,360.27 1,236.25 1,623.33 1,530.96 1,671.42 Total Liabilities Growth (%) 10.03 -23.84 6.03 -8.40 -4.51 Total Equity 1,053.63 1,260.42 2,582.39 2,255.88 2,004.40 Total Equity Growth (%) -16.41 -51.19 14.47 12.55 14.51 Current Ratio (x) 0.51 0.54 0.82 0.81 0.67 Total Debt to Equity (x) 0.44 0.37 0.21 0.28 0.29 Contingent Liabilities 2,099.22 2,251.61 2,145.21 2,198.98 2,014.23 All figures in Rs Cr, unless mentioned otherwise

-

Annual FY 2021 FY 2020 FY 2019 FY 2018 FY 2017 Net Cash flow from Operating Activities 291.68 50.83 401.97 235.27 235.15 Net Cash used in Investing Activities -167.75 96.00 -242.66 -193.91 -501.20 Net Cash flow from Financing Activities -109.53 -154.10 -176.69 -32.98 238.18 Net Cash Flow 15.49 4.61 -8.40 8.34 -26.90 Closing Cash & Cash Equivalent 26.56 11.07 6.46 14.86 6.52 Closing Cash & Cash Equivalent Growth (%) 139.93 71.36 -56.53 127.91 -80.49 Total Debt/ CFO (x) 1.58 9.10 1.34 2.63 2.47 All figures in Rs Cr, unless mentioned otherwise

-

Annual FY 2021 FY 2020 FY 2019 FY 2018 FY 2017 Return on Equity (%) -17.33 -112.76 10.46 10.22 12.81 Return on Capital Employed (%) -3.44 0.65 13.36 13.77 15.60 Return on Assets (%) -7.46 -56.28 6.39 6.05 7.00 Interest Coverage Ratio (x) -0.32 0.30 5.10 4.57 6.91 Asset Turnover Ratio (x) 0.13 0.23 24.52 25.35 38.07 Price to Earnings (x) -1.33 -0.06 2.79 6.89 10.04 Price to Book (x) 0.23 0.07 0.29 0.70 1.29 EV/EBITDA (x) -19.52 24.25 2.72 5.37 7.72 EBITDA Margin (%) -12.90 2.59 39.19 39.38 27.60

Technicals

-

Buy / Sell Signals

-

Price Analysis

-

Pivot Levels & ATR

-

Chart

-

Stock doesn't have any Buy/Sell Signals.

-

Price Analysis Data details are not available.

-

Pivot Levels

R1 R2 R3 PIVOT S1 S2 S3 Classic - - - - - - - Average True Range

5 DAYS 14 DAYS 28 DAYS ATR - - -

Peer Comparison

-

Stock Performance

-

Ratio Performance

-

Insights

-

Stock Returns vs Nifty Smallcap 100

Stock gave a 3 year return of -61.33% as compared to Nifty Smallcap 100 which gave a return of 30.79%. (as of last trading session)

- 1D

- 1W

- 1M

- 3M

- 6M

- 1Y

- 5Y

All values in %

Choose from Peers

- Mukta Arts

- Cinevista Ltd

- Pritish Nandy

- Radaan Media

- Creative Eye

-

-

Insights

-

Stock Returns vs Nifty Smallcap 100

Stock gave a 3 year return of -61.33% as compared to Nifty Smallcap 100 which gave a return of 30.79%. (as of last trading session)

Ratio Performance

NAME P/E (x) P/B (x) ROE % ROCE % ROA % Rev CAGR [3Yr] OPM NPM Basic EPS Current Ratio Total Debt/ Equity (x) Total Debt/ CFO (x) Eros Media -1.85 0.25 -17.33 -3.44 -7.46 -27.03 -16.84 -69.03 -18.90 0.51 0.44 1.58 Balaji Telef -4.27 1.27 -29.81 -29.02 -19.50 -9.09 -38.41 -39.53 -13.09 2.14 0.10 0.00 UFO Moviez -3.95 1.39 -44.42 -35.97 -22.60 -44.51 -158.45 -135.01 -41.48 1.23 0.23 -3.79 Shemaroo Entertain 57.02 0.53 0.90 5.26 0.59 -12.25 8.14 1.32 1.94 2.88 0.43 0.00 Imagicaaworld Entert -0.50 -0.14 0.00 6.49 -27.96 -32.41 -77.61 -338.77 -27.71 0.08 -1.25 0.00 Add More Annual Ratios (%)

Choose from Peers

- Mukta Arts

- Cinevista Ltd

- Pritish Nandy

- Radaan Media

- Creative Eye

See All Parameters

-

MF Ownership

MF Ownership details are not available.

Top Searches:

Corporate Actions

-

Board Meeting/AGM

-

Dividends

- Others

-

Meeting Date Announced on Purpose Details May 29, 2022 May 20, 2022 Board Meeting Audited Results May 19, 2022 May 16, 2022 Board Meeting To consider issue of Warrants May 13, 2022 May 10, 2022 Board Meeting To consider issue of Warrants Mar 23, 2022 Feb 18, 2022 POM - Feb 11, 2022 Feb 04, 2022 Board Meeting Quarterly Results -

Type Dividend Dividend per Share Ex-Dividend Date Announced on Final 15% 1.5 Feb 21, 2013 Feb 12, 2013 -

No other corporate actions details are available.

About Eros Media

Eros International Media Ltd., incorporated in the year 1994, is a Small Cap company (having a market cap of Rs 264.16 Crore) operating in Media & Entertainment sector. Eros International Media Ltd. key Products/Revenue Segments include Program/ Film Rights and Service Income for the year ending 31-Mar-2021. For the quarter ended 31-12-2021, the company has reported a Consolidated Total Income of Rs 233.06 Crore, up 121.81 % from last quarter Total Income of Rs 105.07 Crore and up 186.46 % from last year same quarter Total Income of Rs 81.36 Crore. Company has reported net profit after tax of Rs 27.05 Crore in latest quarter. The company's top management includes Mr.Dhirendra Swarup, Mr.Pradeep Dwivedi, Ms.Bindu Saxena, Mr.Kishore Arjan Lulla, Mr.Sunil Arjan Lulla, Mr.Dhirendra Swarup, Mr.Manmohan Kumar Sardana, Mr.Pradeep Dwivedi, Ms.Bindu Saxena, Mr.Kishore Arjan Lulla, Mr.Sunil Arjan Lulla, Mr.Manmohan Kumar Sardana. Company has Chaturvedi & Shah LLP as its auditors. As on 31-03-2022, the company has a total of 9.59 Crore shares outstanding. Show More

-

Executives

-

Auditors

-

DS

Dhirendra Swarup

Non Exe.Chairman&Ind.Director

DS

Dhirendra Swarup

Non Exe.Chairman&Ind.Director

SA

Sunil Arjan Lulla

Exec. Vice Chairman & Mang Dir

SA

Sunil Arjan Lulla

Exec. Vice Chairman & Mang Dir

PD

Pradeep Dwivedi

Executive Director & CEO

PD

Pradeep Dwivedi

Executive Director & CEO

KA

Kishore Arjan Lulla

Executive Director

KA

Kishore Arjan Lulla

Executive Director

BS

Bindu Saxena

Ind. Non-Executive Director

BS

Bindu Saxena

Ind. Non-Executive Director

MK

Manmohan Kumar Sardana

Ind. Non-Executive Director

MK

Manmohan Kumar Sardana

Ind. Non-Executive Director

VT

Vijay Thaker

Co. Secretary & Compl. Officer

VT

Vijay Thaker

Co. Secretary & Compl. Officer

Show More

Address

201, 2nd Floor, Kailash Plaza,Opp Laxmi Industrial Estate,Off Andheri Link Road,Mumbai, Maharashtra - 400053

More Details

FAQs about Eros Media

-

1. What is Eros Media share price and what are the returns for Eros Media share?

Eros Media share price was Rs 27.55 as on 27 May, 2022, 03:57 PM IST. Eros Media share price was up by 4.95% based on previous share price of Rs. 26.95. In last 1 Month, Eros Media share price moved down by 11.56%.

-

2. Who owns Eros Media?

Following are the key changes to Eros Media shareholding:

- Promoter holding have gone down from 60.9 (30 Jun 2021) to 48.07 (31 Mar 2022)

- Domestic Institutional Investors holding has not changed in last 9 months and holds 0.0 stake as on 31 Mar 2022

- Foreign Institutional Investors holding has gone up from 7.92 (30 Jun 2021) to 8.22 (31 Mar 2022)

- Other investor holding has gone up from 31.18 (30 Jun 2021) to 43.71 (31 Mar 2022)

-

3. Who is the Chief Executive Officer of Eros Media?

Pradeep Dwivedi is the Executive Director & CEO of Eros Media

-

4. What is the market cap of Eros Media?

Market Capitalization of Eros Media stock is Rs 264.16 Cr.

-

5. What has been highest price of Eros Media share in last 52 weeks?

52 Week high of Eros Media share is Rs 38.40 while 52 week low is Rs 16.45

-

6. How can I quickly analyze Eros Media stock?

Key Metrics for Eros Media are:

- PE Ratio of Eros Media is -1.85

- Earning per share of Eros Media is -14.86

- Price/Sales ratio of Eros Media is 0.92

- Price to Book ratio of Eros Media is 0.24

-

7. Which are the key peers to Eros Media?

Top 10 Peers for Eros Media are Shemaroo Entertainment Ltd., UFO Moviez India Ltd., Mukta Arts Ltd., Imagicaaworld Entertainment Ltd., Cinevista Ltd., Pritish Nandy Communications Ltd., Creative Eye Ltd., Radaan Mediaworks (I) Ltd., Sri Adhikari Brothers Television Network Ltd. and Balaji Telefilms Ltd.

Eros Media Share Price Update

Eros International Media Ltd. share price moved up by 4.95% from its previous close of Rs 26.25. Eros International Media Ltd. stock last traded price is 27.55

Eros International Media Ltd. share price moved up by 4.97% from its previous close of Rs 26.15. Eros International Media Ltd. stock last traded price is 27.45

| Share Price | Value |

|---|---|

| Today/Current/Last | 27.55 27.45 |

| Previous Day | 26.25 26.15 |

Trending in Markets

DATA SOURCES: TickerPlant (for live BSE/NSE quotes service) and Dion Global Solutions Ltd. (for corporate data, historical price & volume, F&O data). Sensex & BSE Quotes and Nifty & NSE Quotes are real-time and licensed from BSE and NSE respectively. All timestamps are reflected in IST (Indian Standard Time).

DISCLAIMER: Any and all content on this website including tools/analysis is provided to you only for convenience and on an "as-is, as- available" basis without representation and warranties of any kind. The content and any output of such tools/analysis is for informational purposes only and should not be relied upon or construed as an investment advice or guarantee for any specific performance/returns advice or considered as recommendation for the purchase or sale of any security or investment. You are advised to exercise caution, discretion and independent judgment with regards to the same and seek advice from professionals and certified experts before taking any decisions.

By using this site, you agree to the Terms of Service and Privacy Policy.

Source: https://economictimes.indiatimes.com/eros-international-media-ltd/stocks/companyid-32234.cms

0 Response to "Why Did Burger King Have the Zero Beef Burger"

Post a Comment